VAT in the EU can be complicated for some: While all VAT guidelines are set at the European Union level, member countries are allowed to implement them as they see fit for their particular regions.

The good news is, in certain situations, businesses that are not based in the EU but have incurred VAT in connection to business activities in the region, are entitled to a refund on the VAT paid. We can support with fiscal representation services to help you reclaim those costs.

Overview of VAT in the EU

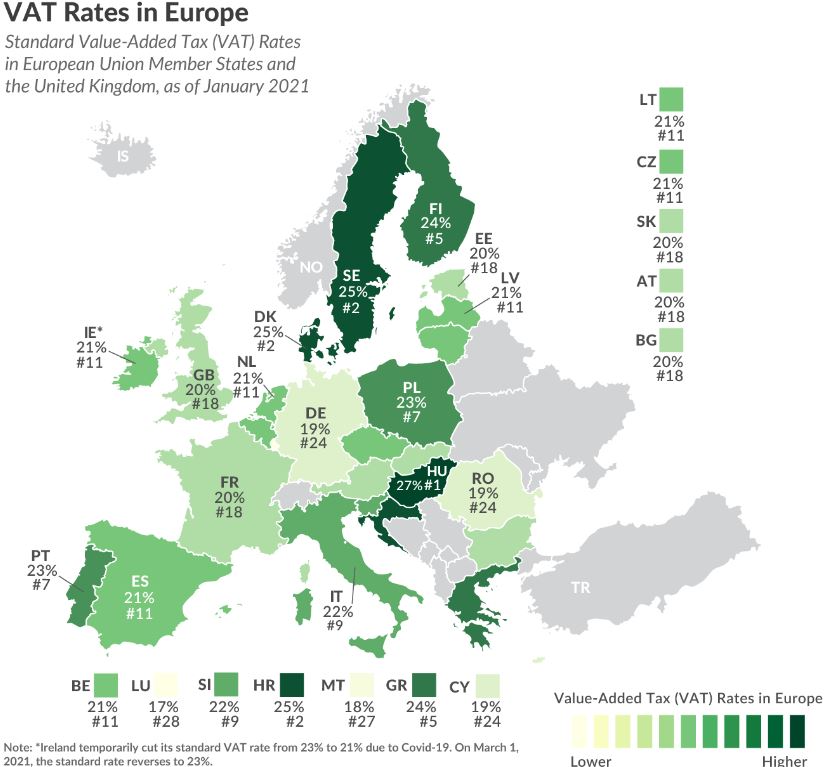

The VAT rates in the EU range from 17% to 27%, with Luxembourg having the lowest rate and Hungary with the highest. EU regulation requires VAT to be ‘at least 15%’, and the average among the 27 countries is 21%.

Here are the types of VAT rates within the EU:

Standard Rate

The standard rate is the regular rate applied to most goods and services. It should not be lower than 15%.

Reduced Rate

The reduced rate may be applied to some goods and services and should not be less than 5%. It is usually not applicable for electronically supplied services.

Special Rate

Some EU countries have set special rates for products since January 1, 1991. The Single Market was supposed to phase out the special rate in 1993, but some countries continued it.

There are three types of special rates:

- Super-Reduced Rates – Less than 5% tax levied on sales of a limited list of goods and services.

- Zero Rates – Some items have no tax at all.

- Parking Rates – Also called intermediary rates, these are applied to some goods and services from countries allowed to continue using reduced rates. They should not be lower than 12%

Import Duties on Medical Devices in the EU

Aside from VAT, imported medical devices are charged with EU customs and import duties. For easy identification of import duties, goods and commodities are coded through a Harmonised System (HS), recognized by over 200 countries. The VAT rates levied on them are either the standard rate that should not be less than 15% or the reduced rate, which should not be less than 5%.

HS codes for medical devices begin with the following:

- 9018 – for instruments and appliances used in medical, surgical, dental, or veterinary sciences.

- 9019 – for mechano-therapy appliances, massage apparatus, psychological aptitude-testing apparatus, and devices used in ozone therapy, oxygen therapy, aerosol therapy, artificial respiration, or other therapeutic respiration apparatus.

- 9020 – for breathing appliances and gas masks.

- 9021 – for orthopedic appliances, artificial body parts, and other appliances worn, carried, or implanted in the body to compensate for a defect or disability.

- 9022 – for apparatus based on the use of X-rays and other ionizing radiations, and related products and devices, including examination or treatment tables and chairs.

Due to the pandemic, the EU temporarily waived import duties on essential medical devices.

Some items not considered medical devices are used in healthcare. There are recommended tariffs for them, but it is up to the receiving country to levy customs duty.

Are You Eligible for VAT Refund?

Medical device manufacturers outside the EU can ask for a refund if they were charged VAT for doing business within the EU. The process is easy and can be done online.

Here’s a guide to applying for a refund:

- Submit an application for a refund to the Member State Establishment (MSE).

- The MSE will reply with a confirmation receipt and forward the application to the Member State of Refund (MSR) or the country that levied the VAT within 15 days.

- The MSR may ask for additional information—send your reply within 30 days of receiving the request.

- The MSR will decide to make a partial or full payment within eight months of receiving the application.

- You will receive the refund from the MSR according to how you want to get it, as stated in your application.

Importance of VAT Information When Doing Business in the EU

The EU has a thriving economic market for medical and in-vitro devices. Importing products into the 27 member states can be a complex process, and non-EU manufacturers must know their obligations and what they can expect. VAT refunds can significantly mitigate import costs, and it’s an essential service that manufacturers should pursue.

GrowthImports can act as your European fiscal representative and support with reclaiming your VAT in the European Union.